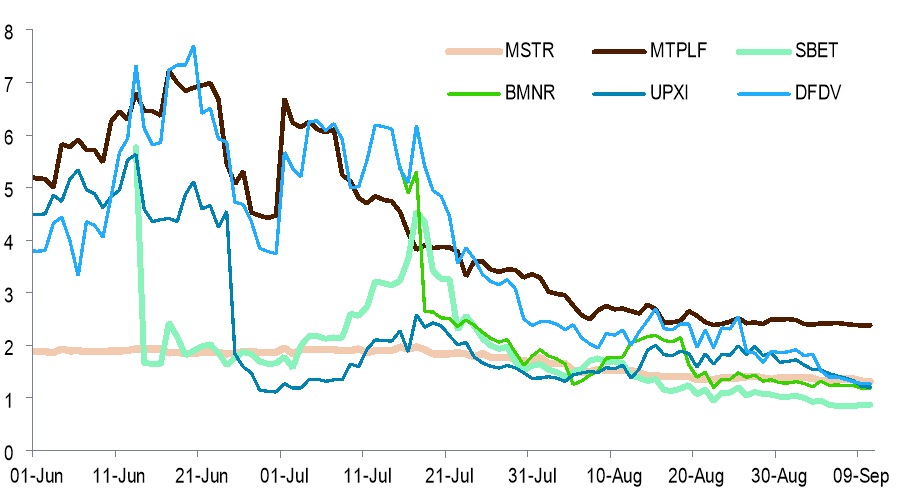

According to the ever-so-serious sages at Standard Chartered Bank, the exquisite modified net asset values (mNAVs) of bitcoin treasury companies are taking a tragic nosedive, as if to remind us that even digital gold must sometimes sulk in the corner.

BTC Decides to Nap While DATs Flail Gracefully

Ah, Michael Saylor’s Strategy (Nasdaq: MSTR) has once again displayed the admirable habit of accumulating a modest 525 bitcoins this Monday, nudging the hoard to a staggering 638,985 BTC. Yet, oh cruel fate! The mNAV took a timid dip to a mere 1.47. The learned minds at Standard Chartered now whisper that these low mNAVs are the melancholic ballads that haunt digital asset treasury companies (DATs), putting a damper on the “fresh buying” spree, which might, just might, explain why bitcoin decided to pause its dramatic waltz upward. 💤

For the uninitiated, mNAV is the delicate math of a company’s enterprise value compared to the dollar worth of its bitcoin treasure trove. There was a golden era when bitcoin DATs like Strategy proudly flaunted mNAVs as high as 3.00-meaning that MSTR was valued thrice the market price of its BTC stash. Quite the confidence, wouldn’t you agree?

But alas, as more companies rushed to hop on the DAT bandwagon with all the subtlety of a parade of elephants, those mNAVs have dwindled to a paltry 1.00. At this juncture, Standard Chartered predicts it will be nigh impossible for these DATs to keep gobbling up bitcoin. A sobering thought for those addicted to the thrill of acquisitions.

“Digital asset treasuries (DATs) have stumbled recently,” declared Geoffrey Kendrick, the oracle of digital asset research at Standard Chartered, in his Monday newsletter. “A higher mNAV implies a business that’s practically Titanic-proof, buying more coins with reckless abandon. A lower mNAV? The sobering reality that they might just have to stop dancing-at least for now.”

A Cheerfully Mundane Overview of Market Metrics

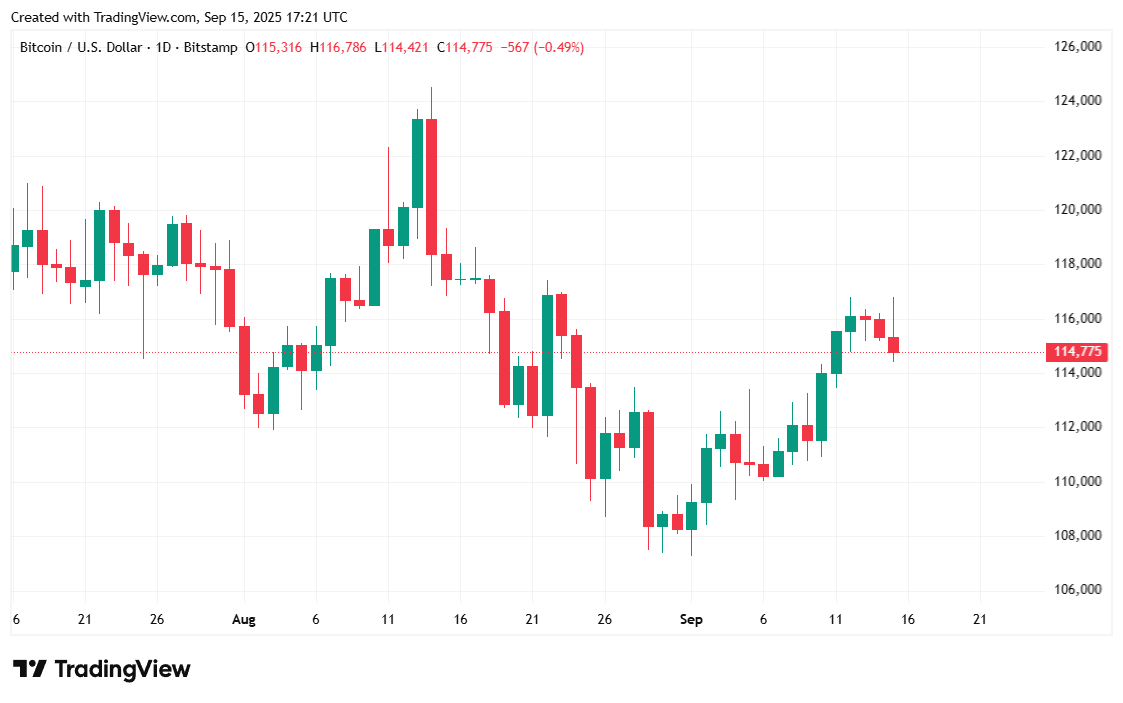

At the time of this very moment, Bitcoin was modestly priced at $114,883.07, nearly as flat as a Shakespearean idiot’s wit, sliding down a trifling 0.56% over 24 hours according to Coinmarketcap. It has gallivanted between $114,461.06 and $116,747.88 since Sunday, offering nothing more exciting than a polite yawn.

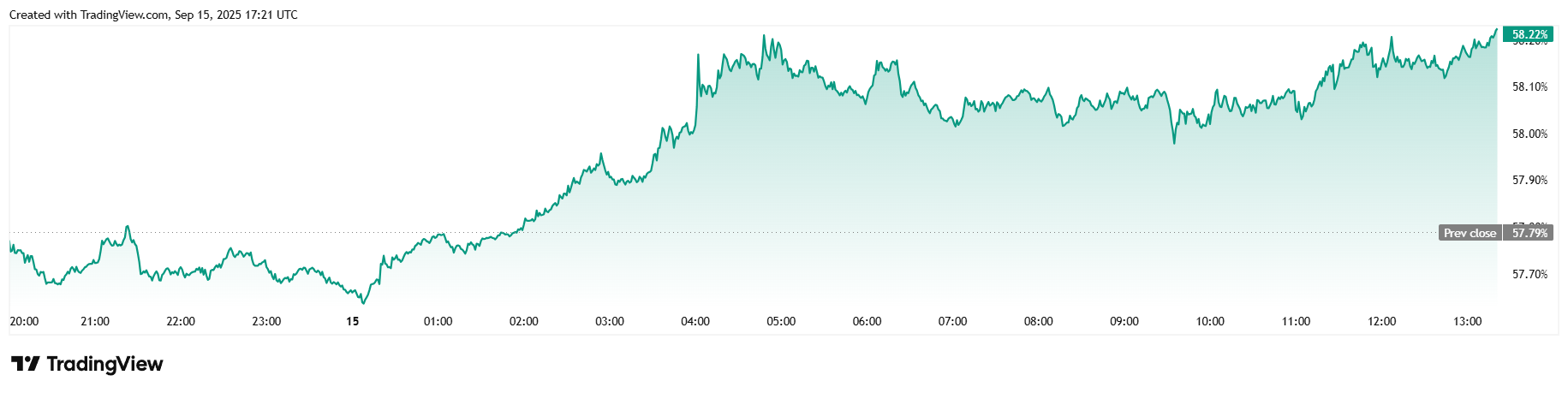

Oh, but don’t be fooled by the calm: the twenty-four-hour trading volume shot up by a respectable 55.56% to reach $49.79 billion, probably the market’s way of nursing a hangover after a relaxed weekend. Market capitalization, playing it cool and uninterested, dipped by a matching 0.56% to a mere $2.28 trillion. Meanwhile, Bitcoin dominance, ever the modest diva, nudged up 0.73% to 58.22%, because why not?

For those who crave the drama of futures, bitcoin futures open interest barely moved, slipping a minuscule 0.22% to $83.12 billion according to Coinglass. Liquidations were a modest $45.92 million overall-nothing a dandy soothsayer wouldn’t consider trifling-with longs bleeding $35.22 million and shorts the paltry remainder of $10.70 million. Alas, the tempest in the teapot continues. 🎩💸

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-09-15 21:38