What to Know:

- MSCI’s sneaky little consultation to kick Bitcoin-heavy companies out of major indexes has turned Strategy into a wild experiment in forced selling.

- JPMorgan dropped a bearish bomb on Strategy, just as the market was teetering, sparking rumors of shorts and a full-blown JPMorgan boycott.

- Bitcoin Hyper’s $HYPER token is here to be the clean, crypto-native way to scale Bitcoin without the politics, offering staking, presale access, and all the fun Bitcoin goodies!

When the market took a nosedive on October 10, there was no ETF rejection, no bombshell regulation, nothing big… Just a good old-fashioned flush that made you wonder if someone was secretly pulling the strings. Very engineered vibes.

The culprit? MSCI. On October 10, they casually launched a consultation to potentially boot companies with 50% or more Bitcoin on their balance sheets from their prestigious global equity indexes. So, you know, nothing too alarming, just your run-of-the-mill industry-changing move.

Enter Strategy ($MSTR), which thrives on Bitcoin accumulation. If MSCI pulls the trigger, expect billions in forced selling. Because, you know, index funds have to follow the rules and sell off those assets like a high-schooler forced to clean their room.

Then, like clockwork, JPMorgan came to the rescue with their bearish note, giving everyone nightmares about the forced selling risk, which they estimate to be around $2.8B. Thanks for that, guys!

The note caused a stir, especially since it had been sitting there for weeks, quietly waiting for the market to be in turmoil to “urgently” surface it. Some called it manipulation, others called it just bad timing. Either way, it didn’t do much for the mood.

Oh, and did we mention the viral #BoycottJPMorgan campaign? It turns out a bunch of people think closing their JPMorgan accounts will somehow fix the global financial system. Hilarious, but I respect the passion.

Michael Saylor was not having it, by the way. He went full defense mode, claiming that Strategy is not some Bitcoin hoarding company, but a legitimate software and financial engineering business. But, hey, what does MSCI know about real business?

The consultation runs until the end of the year, and the final decision on January 15, 2026, looms like a shadow over all those Bitcoin-heavy companies.

So, yeah, this isn’t just some “oops, market crash” moment. It’s about how MSCI’s rules, a bank’s note, and a few spicy rumors can shake up the Bitcoin world faster than you can say “forced selling.” Which is exactly why smart money is rotating into pure Bitcoin infrastructure and presale tokens like Bitcoin Hyper ($HYPER). At least there, you can have some peace of mind.

Bitcoin Hyper ($HYPER): A Glimmer of Hope in the Bitcoin Storm

Bitcoin Hyper ($HYPER) is here to make $BTC faster, cheaper, and more programmable. It’s like a Bitcoin turbocharger, giving you the speed and scalability you always dreamed of. The $HYPER token powers the whole thing, from gas fees to staking. A real game-changer.

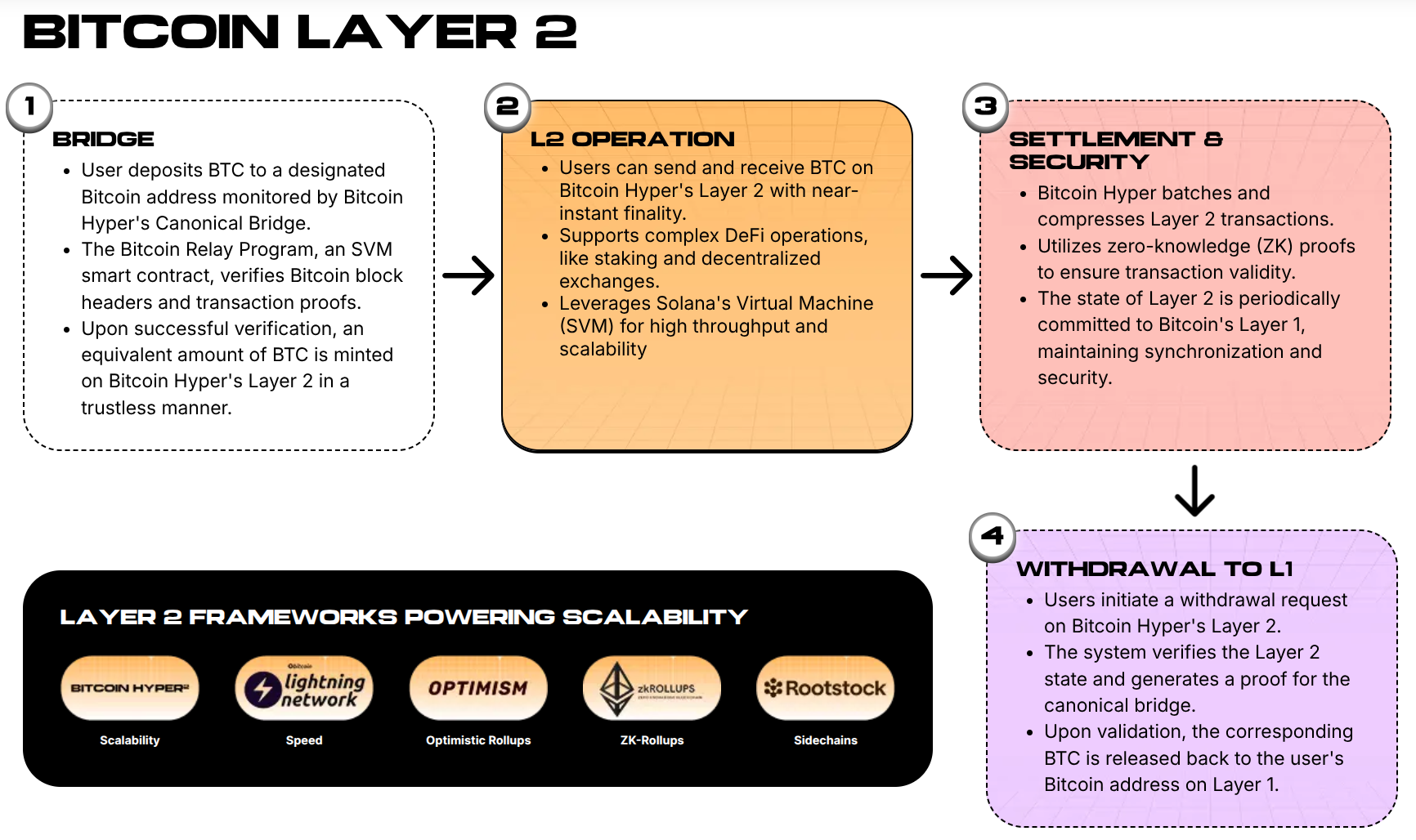

Mechanically, it’s all pretty standard for anyone familiar with Layer-2 tech. Bitcoin is locked on the Bitcoin Layer-1 via a bridge, and a relay program verifies Bitcoin block headers and proofs. From there, it’s off to the races. We’re talking Solana Virtual Machine with high throughput, low latency, and a whole new world of possibilities like payments, DeFi, and meme coins (yes, meme coins!).

Why does this matter? Well, if MSCI and other index providers start penalizing companies that hold Bitcoin, people are going to need somewhere to put all that Bitcoin leverage. Enter Bitcoin Hyper, the Layer-2 where returns are tied to actual network usage, not index politics. If you want Bitcoin exposure without the MSCI/JPMorgan drama, this is your ticket.

While banks debate whether Strategy belongs in an index, Bitcoin Hyper is busy building the infrastructure that will actually matter. No politics, no index exclusions, just pure crypto freedom.

Want more details on how Bitcoin Hyper might change the game? Check out our

The Bitcoin Hyper Presale and Staking: A Wild Ride

Let’s talk about the numbers, shall we? Our Bitcoin Hyper price prediction says that if the project sticks to its roadmap-mainnet, bridge, early dApps, and listings-we could see the $HYPER token reach as high as $0.08625 by late-2026. That’s an ROI of over 547%, assuming the stars align. Nothing’s guaranteed, but the math checks out. So it’s no wonder traders are ditching their $MSTR plays in favor of this juicy Layer-2 bet.

Oh, and don’t forget about the presale. $HYPER has already raised over $28.45M. Yes, you read that right. And some whales have gone all-in with buys as high as $502.6K. These are the kinds of moves that make you think, “Okay, maybe I should pay attention.” 🙃

On top of that, staking has become its own little money-making machine. With 41% APY and 1.3B $HYPER locked up, that’s a chunk of the supply out of circulation before it even lists. So, no panic selling… at least, not yet.

But, of course, high APYs don’t last forever. Once those unlocks and yield rotations hit, the latecomers might get burned. So if you’re not in yet, well, you know what to do. But do it quickly, because Bitcoin Hyper is charging full speed ahead.

Timeline-wise, we’re looking at a Q4 2025/Q1 2026 mainnet launch, with exchange listings and a DAO roll-out to follow. And wouldn’t you know it? That lines up perfectly with the MSCI decision window.

Don’t miss out-get in on the $HYPER action before the next price increase!

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- What If Karlach Had a Miss Piggy Meltdown?

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- Yakuza Kiwami 2 Nintendo Switch 2 review

- Gold Rate Forecast

- This Minthara Cosplay Is So Accurate It’s Unreal

- The Beekeeper 2 Release Window & First Look Revealed

- Burger King launches new fan made Ultimate Steakhouse Whopper

- Brent Oil Forecast

- ‘Zootopia 2’ Is Tracking to Become the Biggest Hollywood Animated Movie of All Time

2025-11-25 17:29