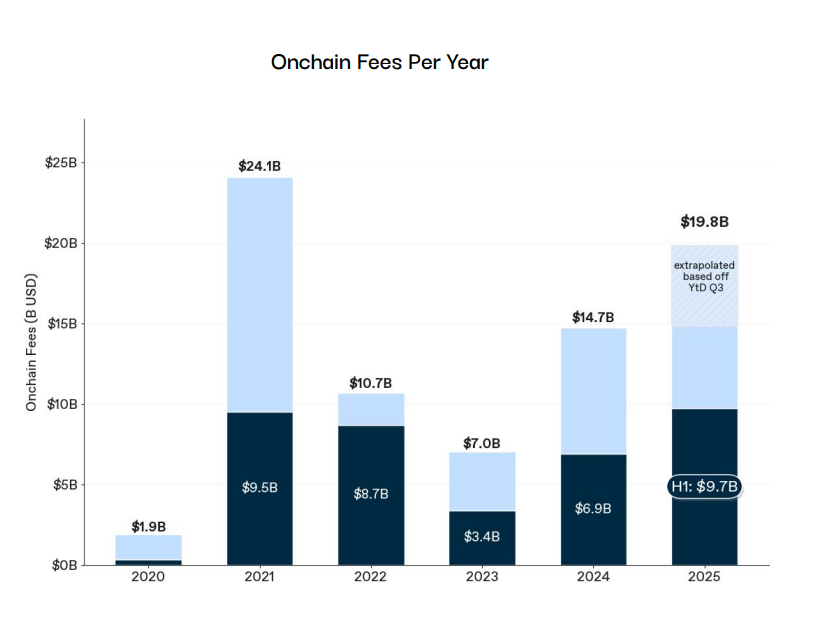

Well, hold on to your wallets, because according to the ever-watchful investment hawks at 1kx, onchain fees are about to hit a jaw-dropping $19.8 billion in 2025. Yes, you read that right-a 35% bump from last year. If you thought your credit card bills were steep, just wait until you see what blockchain is charging.

1kx, in its recently published H1 2025 Onchain Revenue Report (fancy, right?), has some spicy details: application-layer fees are up a cool 126% year-over-year. Meanwhile, blockchain-layer fees have taken a slight dip. Users, being the troopers they are, paid $9.7 billion in onchain fees during the first half of 2025. That’s the highest H1 total on record. It’s almost like the blockchain is the new mall-except instead of buying shoes, you’re buying transaction rights.

In their analysis, 1kx examined a whopping 1,244 protocols across six sectors. They pulled data from sources like Dune, TokenTerminal, and DeFiLlama, and if those names don’t make you feel like a financial expert, well, they should.

Between 2020 and Q3 2025, these protocols were categorized into blockchains, decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN for short), wallets, middleware, and consumer applications. A real smorgasbord of modern finance! Think of it as the blockchain buffet you never asked for but somehow can’t stop coming back to.

DeFi protocols were the big winners, generating 63% of all onchain fees in H1 2025-about $6.1 billion. Who’s leading the pack? Decentralized exchanges (DEXs), perpetual trading platforms, and lending markets. Meanwhile, blockchain fees have dropped to 22%-a far cry from the 56% they commanded in 2021. If you’re wondering where the rest of the fees went, wallets are sitting pretty at 8%, consumer applications at 6%, and DePIN and middleware share a humble 1% each. In short, blockchain got a whole lot cheaper, and the little guys are raking it in.

Blockchain Efficiency Gains Reshape Fee Distribution

The average blockchain transaction fee? Oh, it dropped by a staggering 86% from its peak in 2021. Thanks to Ethereum‘s scaling efforts (yes, it actually did something useful for once), transaction fees have been slashed by a smooth 95%. Ethereum, once the king of fees, generated more than 40% of all on-chain fees in 2021. Now? It’s down to less than 3%. But hey, at least Ethereum’s not as irrelevant as that 10-year-old phone you still refuse to throw away.

And don’t get me started on daily transactions-those increased by 2.7 times, reaching a wild 169 million. Meanwhile, monthly active wallets jumped 5.3 times, climbing to 273 million. That’s a lot of people clicking “approve” on gas fees.

New Protocols Capture Market Share in High-Growth Sectors

Enter the new kids on the block: Solana-based DEXs like Meteora and Raydium have been snatching market share from Uniswap, whose portion shrank from 44% to a meager 16%. Meanwhile, Hyperliquid, which launched less than a year ago, is already pulling in 35% of the derivatives fee market. Good luck, Uniswap-there’s a new sheriff in town.

Oh, and did I mention Jupiter? It went from a humble 5% to a beastly 45% in perpetual trading fees. Some protocols, such as Phantom wallet, got a jumpstart by beginning monetization in Q4 2024 and now rake in a cool 30% of the wallet sector fees. Talk about entering the game with a bang.

Bar charts showcasing on-chain fees organized by year. | Source: 1kx report

Let’s talk tokenization. Ondo Finance expanded its $1.8 billion tokenization market to BNB Chain in October 2025, with fees skyrocketing 50 times year-over-year. I don’t know about you, but I wouldn’t mind being in their shoes. If only they could figure out how to make tokenized assets as fun as a Friday night out.

Looking to the future, the report predicts that 2026 onchain fees will hit $32 billion-an eye-watering 63% increase. This growth is expected to be driven by applications. Bitcoin, however, remains on the sidelines, with its 58% market cap dominance serving more as a store of value than a fee-generating machine.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Brent Oil Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- EUR INR PREDICTION

- Gold Rate Forecast

2025-10-30 23:08