The $150 billion in total cryptocurrency liquidations seems like a catastrophe at first. Oh, the horror! A mere number, yet it strikes fear into the hearts of even the most stoic investors. 🤯 However, a closer look at the data reveals a much more complex picture that is, to be honest, less dramatic than it might seem. A bit of a damp squib, really. 🧠

The State of Liquidity in Crypto: A Tale of Two Extremes

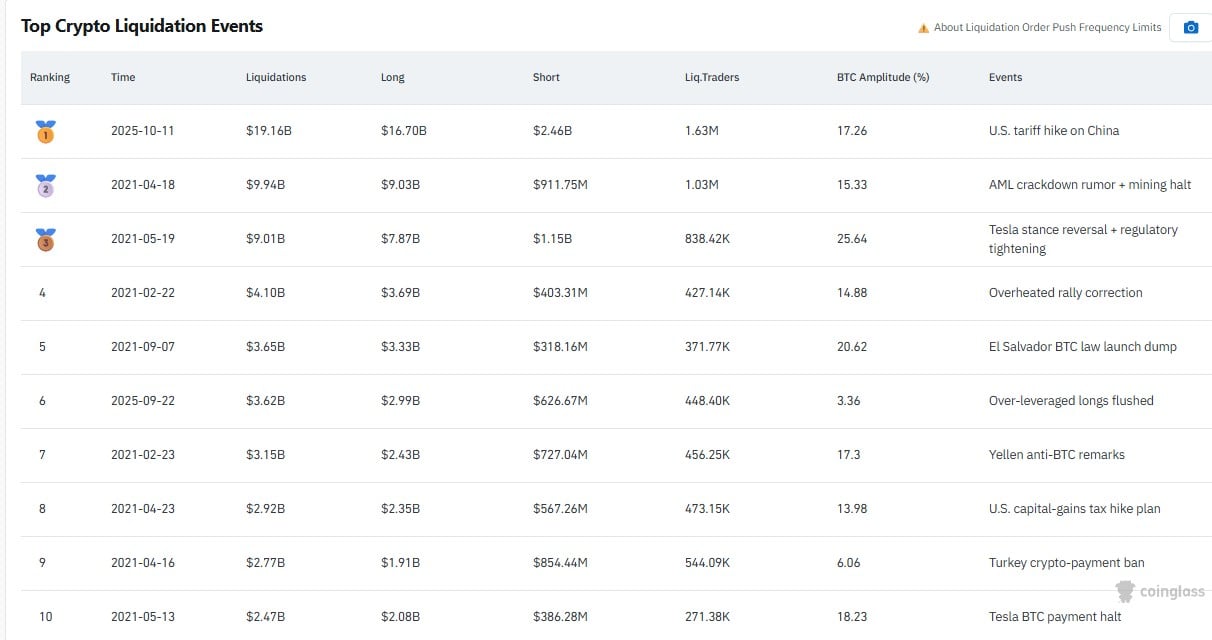

The liquidation overview indicates that the total amount of liquidations in 2025 was approximately $154.6 billion, with the biggest daily wipeout amounting to approximately $19.1 billion. Perception is distorted by that spike alone. Particularly on a market where leverage is deeply ingrained, a single extreme event does not characterize the entire year. It’s like blaming a single rainy day for the entire season. 🌧️

Leverage has been a feature of the cryptocurrency system for years; it did not just become careless in 2025. Over time, the liquidation distribution provides a more lucid narrative. Instead of ongoing systemic stress, liquidations were comparatively contained for the majority of the year, with frequent but mild flushes. Because it was the exception rather than the rule, the enormous spike in October stands out. Like a sore thumb at a tea party. 🎩

Overleveraged traders were easy targets during that event due to aggressive positioning and a sharp increase in volatility. That is, rather than long-term capital, leverage was penalized. A lesson learned, perhaps? 🧨

Open Interest Matters: A Dance of Capital

There is a recurring pattern when examining open interest and volume charts: during bullish periods, open interest increased in tandem with price while, during corrections, it decreased. That is healthy – it implies that capital did not flee, but rather rotated. Growth in volume toward the second half of the year further suggests that after significant liquidations, traders returned, modified their risk and continued to operate. A resilient little thing, this market. 💪

This thesis is supported by the list of the biggest liquidation events. The largest losses were linked to particular triggers, such as positioning imbalances, macro shocks, policy headlines or regulatory rumors. These were stress tests, not haphazard market failures. The market persevered through them all without disrupting its structure. A true show of grit. 🦸♂️

So, was 2025 a terrible year? Not at all. It was a year of volatility, a year of cleansing leverage and a year in which risk management was truly important. Liquidations were the price of getting rid of excess, not a sign of collapse. That is not a weakness for a market that is maturing. Growing up is like that. 🧑🎓

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- 4. The Gamer’s Guide to AI Summarizer Tools

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

2025-12-26 13:52