Good heavens! The once-buoyant Bitcoin ETFs have taken a most unfortunate turn, hemorrhaging a staggering $258 million, while their Ether counterparts have endured a fourth consecutive day of withdrawals, to the tune of $251 million. Fidelity and Bitwise, those erstwhile pillars of stability, have found themselves at the epicenter of this financial fiasco. 😱

Pray, consider the state of the crypto exchange-traded fund (ETF) markets, which have been thrust into a most precarious situation this week. What began as a genteel tug-of-war between inflows and outflows has devolved into a veritable rout, with both bitcoin and ether ETFs suffering most grievously on Thursday, Sept. 25. One can only imagine the consternation among investors! 😓

Bitcoin ETFs, having briefly rebounded on Wednesday, have once again found themselves in the doldrums, with a $258.46 million outflow. Fidelity’s FBTC has borne the brunt of this calamity, losing $114.81 million, while Bitwise’s BITB and Ark 21Shares’ ARKB have shed $80.52 million and $63.05 million, respectively. One wonders if their coffers shall ever recover! 🤑

Grayscale, too, has added to the slide, with its GBTC losing $42.90 million and its Bitcoin Mini Trust a further $15.49 million. Vaneck’s HODL ($10.08 million), Franklin’s EZBC ($6.35 million), and Valkyrie’s BRRR ($4.96 million) have all contributed to this lamentable state of affairs. The sole ray of sunshine amidst this gloom has been Blackrock’s IBIT, which has managed to attract $79.70 million, though it scarcely suffices to stem the tide. Total trading activity has surged to $5.42 billion, yet net assets have dwindled to $144.35 billion. Alas! 😢

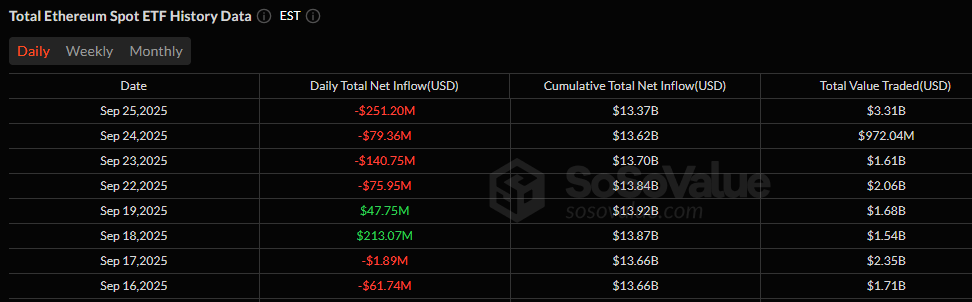

Ether ETFs, alas, have not been spared this turmoil, logging their fourth consecutive day of outflows, amounting to $251.20 million. Fidelity’s FETH has once again led the charge, with $158.07 million in withdrawals. Grayscale’s ETHE and Ether Mini Trust have lost $30.27 million and $26.14 million, respectively, while Bitwise’s ETHW has seen $27.60 million pulled out. One can only imagine the hand-wringing at their headquarters! 🙈

Smaller, yet no less steady, exits have been observed from Franklin’s EZET ($2.98 million), 21Shares’ TETH ($2.36 million), Invesco’s QETH ($2.34 million), and Vaneck’s ETHV ($1.44 million). Total value traded stands at $3.31 billion, as net assets have plummeted to $25.59 billion. A most unfortunate turn of events, to be sure. 😔

With both bitcoin and ether ETFs firmly ensconced in the red, sentiment remains as fragile as a teacup in a bull’s parlor. Investors shall no doubt be watching with bated breath to see whether this selling pressure abates or if the week concludes with yet another wave of redemptions. One can only hope for a modicum of stability in these trying times. 🌪️

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Poppy Playtime Chapter 5 Characters

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

2025-09-26 15:08