TL;DR

- LINK tumbles 20% like a farmer’s luck in a dust storm, clinging to the $26 mirage before hitting the hardpan of support. 🌾💨

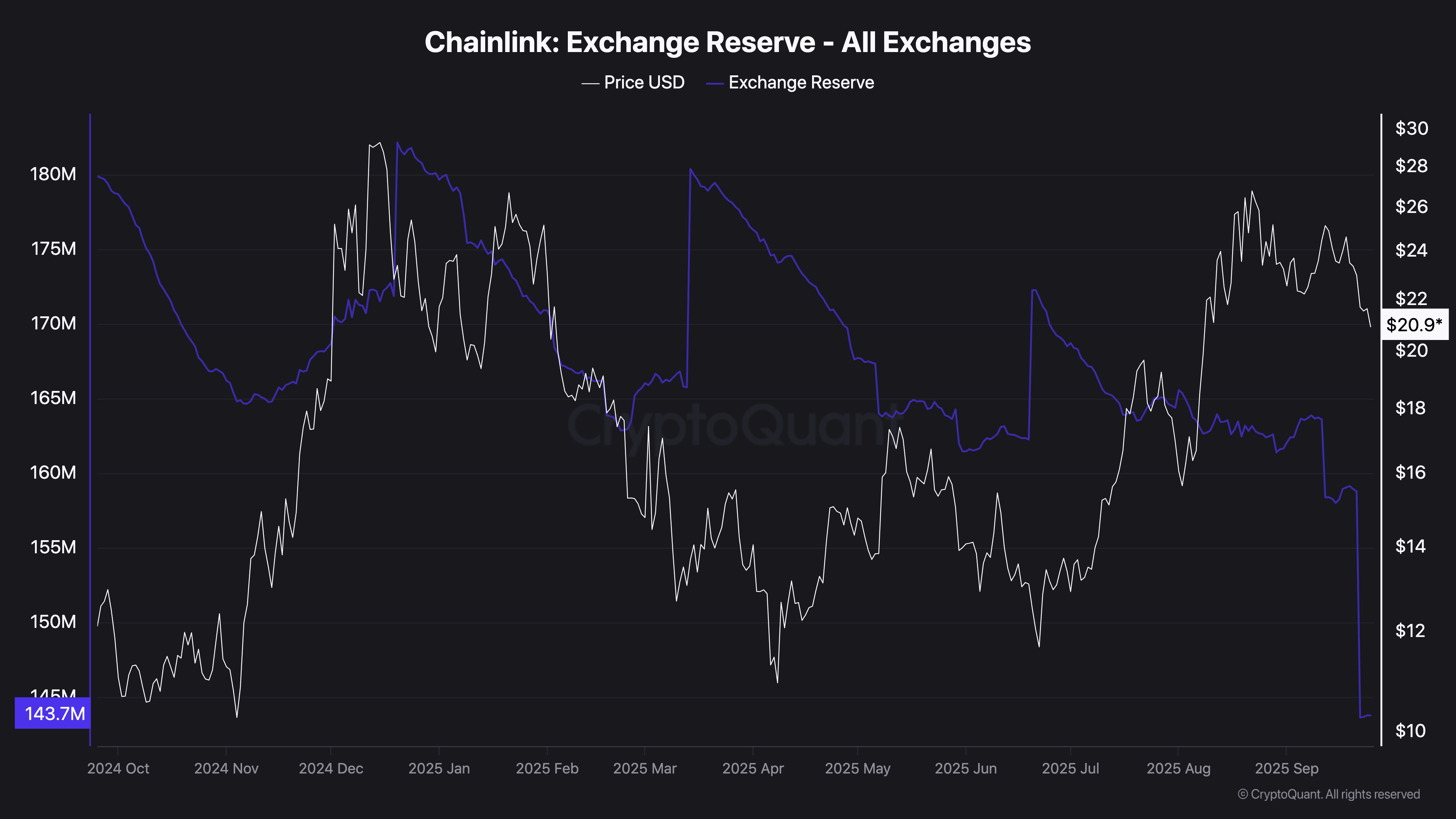

- Exchange reserves shrink to 143.7M LINK, the lowest since the last time someone trusted a weatherman. 🏦📉

- Chainlink cozies up to Canton Network, spreading its oracle gospel like a traveling preacher in a Model T. 🚗🙏

In the parched fields of crypto, Chainlink (LINK) has taken a spill, trading near $21 after a 4% slide in the past day. Over the week, it’s down 14%, like a scarecrow blown sideways in a gale. The recent high of $26 feels as distant as rain in a drought. Now, it’s clinging to a support zone between $19 and $20, a line in the sand that once was a wall of resistance. Hold here, and the dream lives. Break, and it’s a long walk to the broader support of $11 to $14, where it’s been holed up since mid-2023.

Michaël van de Poppe, a market whisperer, reckons this is the moment to plant seeds. “LINK is getting into a higher timeframe support zone,” he says, with the confidence of a man who’s never seen a crop fail. “Very high chance that will hold,” he adds, like a farmer eyeing a promising cloud. His bet? A “new all-time high,” though some traders are still squinting at the horizon, waiting for the storm to pass.

Absolutely legendary moment to be scooping up some of your favourite #Altcoins. $LINK is getting into a higher timeframe support zone.

Very high chance that will hold, and the next rally is likely the rally towards a new ATH. 🌪️💰

– Michaël van de Poppe (@CryptoMichNL) September 25, 2025

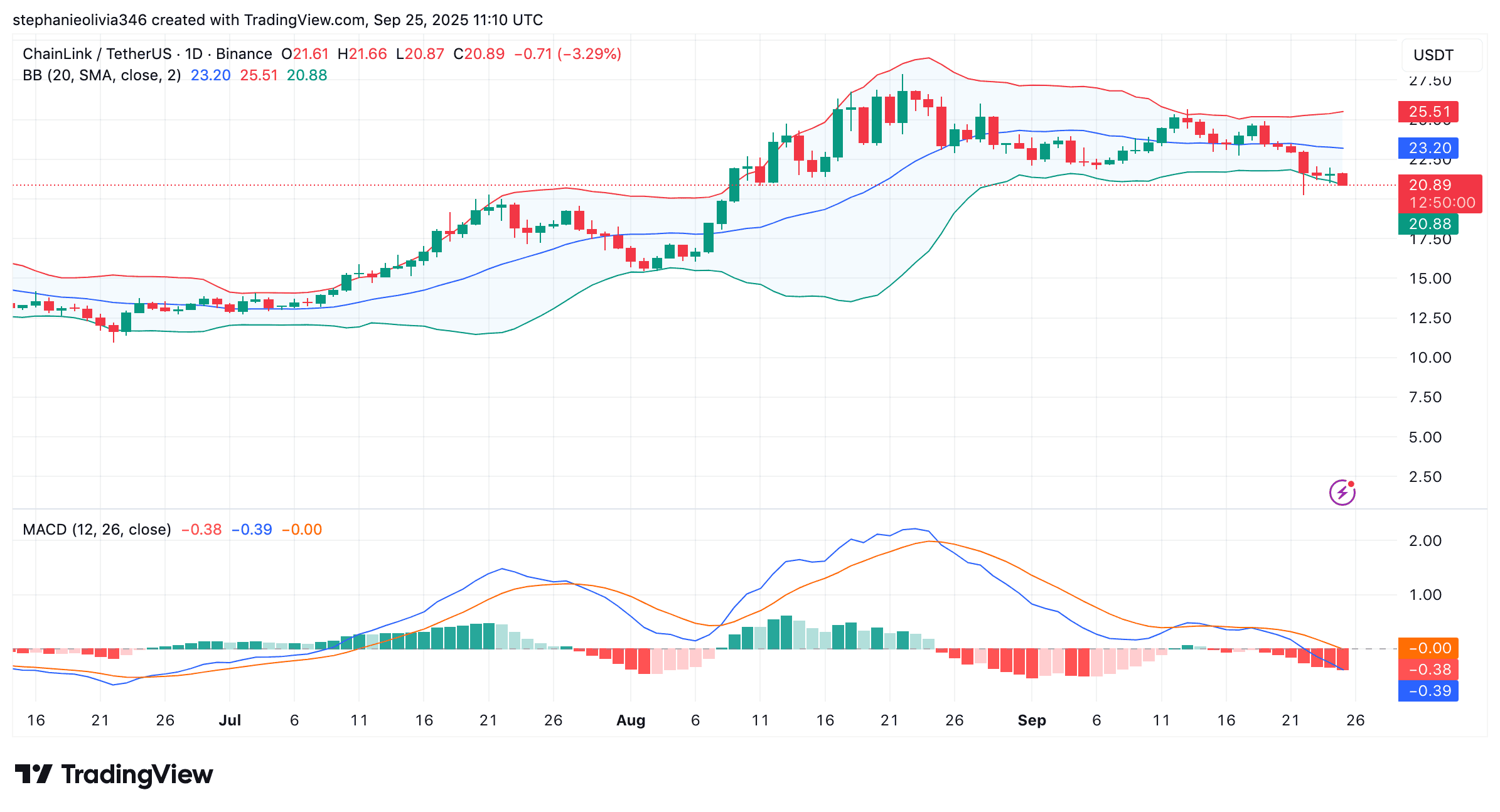

The technicals paint a picture of a weary traveler. LINK’s below the 20-day moving average, like a wagon stuck in the mud, with the price near the lower Bollinger Band at $20. Oversold? Maybe. But the road ahead is as clear as a dust storm. The MACD’s bearish crossover is like a crow circling a field-not a good omen, but not the end of the world either.

Meanwhile, LINK’s exchange reserves have shriveled to 143.7 million, the lowest in over a year. Tokens are fleeing exchanges like rats from a sinking ship, heading to self-custody or long-term holds. Even as the price dropped from $26 to $21, the exodus continued, suggesting traders are hunkering down like farmers in a storm cellar. Fewer tokens on exchanges mean less selling pressure, but whether that’s a blessing or a curse remains to be seen.

Chainlink’s latest partnership with Canton Network is like a marriage of convenience in hard times. Canton, backed by financial bigwigs, will use Chainlink’s oracle and CCIP services, while Chainlink’s Scale initiative helps foot the bill for smart contract oracles. It’s a handshake in the dust, a promise of better days-if the rains ever come. 🌧️🤝

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- 2026 Upcoming Games Release Schedule

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-09-25 18:18