As a seasoned crypto investor with battle scars from multiple market cycles, I have learned to navigate the ever-changing tides of this dynamic market. The recent surge in Ethereum has been nothing short of exhilarating, but I’ve seen this movie before – a bull run followed by a much-needed correction.

Since President Trump’s election, the market for digital currencies has experienced a robust upward trend. Notably, Ethereum has witnessed a substantial increase in value, as investors have taken over and driven up its price.

It seems like the market is preparing for a period of decline, or correction, so it can stabilize before making more progress.

Technical Analysis

By Shayan

The Daily Chart

As an analyst, I’ve observed a surge in new market players and investors, which has fueled an impulsive upward trend for Ethereum. This surge propelled its price beyond both the 100-day and 200-day moving averages. The momentum was so strong that it shattered the resistance at $2.9K (200-day MA) and the psychological barrier at $3K, suggesting a significant bullish shift as the market liquidates short positions, a clear signal of a favorable market movement for Ethereum.

Currently, Ethereum is getting close to a significant barrier at approximately $3,600. This level has substantial offering and could lead to profit-taking, increasing the chances of a brief reversal to reduce buying pressure. This correction might push Ethereum towards its 200-day Moving Average, helping to establish a more steady upward trend.

The 4-Hour Chart

On the 4-hour scale, it’s clear that the recent spike in value started at the lower end of the bearish flag around $2.4K. The strong buying activity caused a burst through the upper limit of the flag, propelling Ethereum beyond the crucial $3K threshold and effectively cancelling out the previous bearish trend prediction.

This strong trend indicates a significant change in investor attitudes, however, given the volatile uptrend, a period of stability or consolidation is likely to follow. A potential dip towards the upper limit of the flag pattern and the $3K support zone could offer an opportunity for the market to balance out. During this pause, investors might have a chance to cash out their profits, while also creating entry points for new investors.

The current technical setup suggests that Ethereum may pause its bullish momentum in the short term. A correction toward $3K would support a healthier continuation of the uptrend, giving the market time to recalibrate before attempting to break higher.

Onchain Analysis

By Shayan

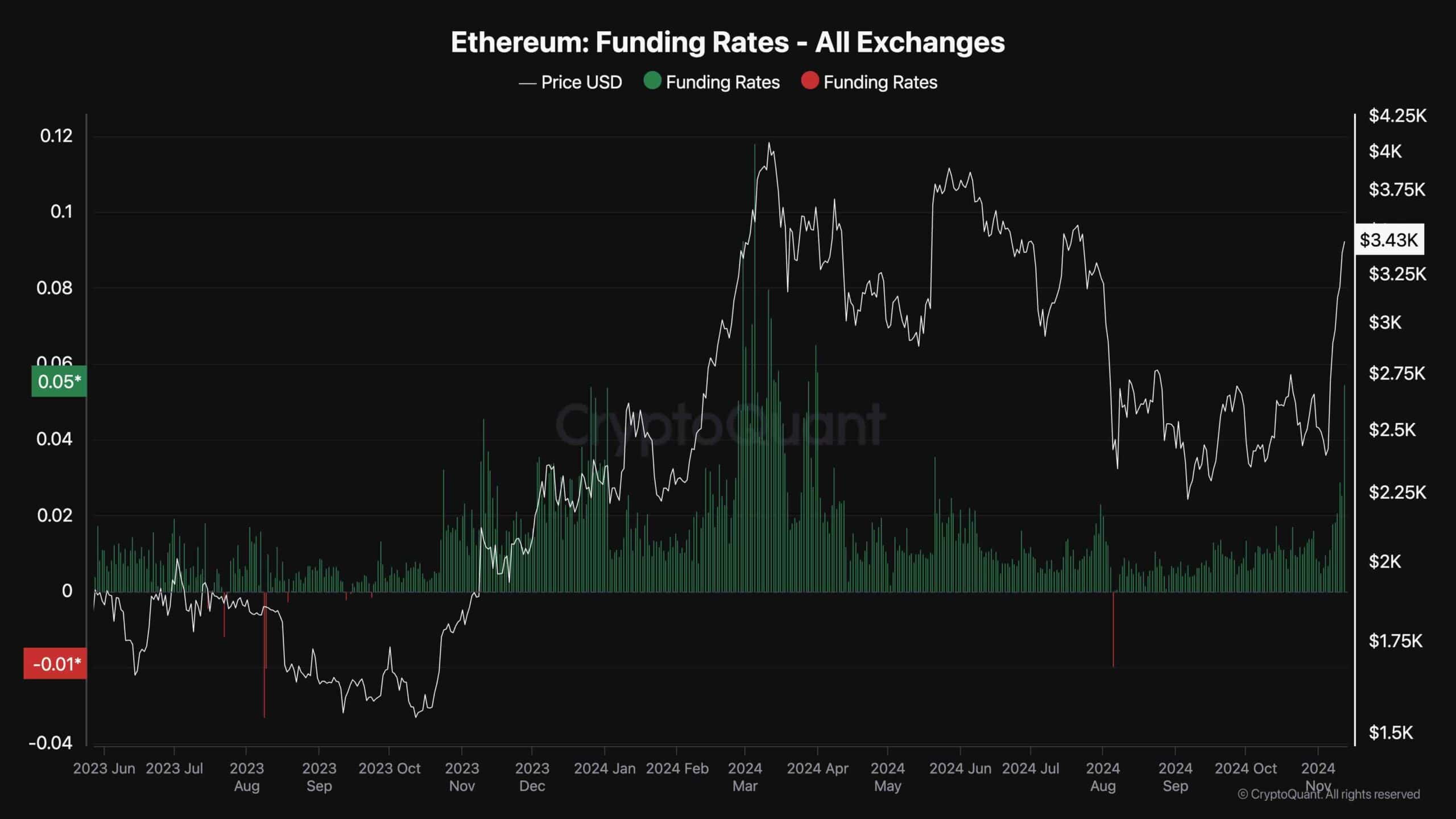

The latest spike in Ethereum, reaching its highest point this year, has rekindled confidence among investors, as they speculate whether we’re witnessing a new push toward record highs. Yet, examining the mood in the futures market could offer valuable clues about any short-term ups and downs.

Looking at the funding rates for ETH futures, it’s clear they have stayed positive over the past few weeks, suggesting a generally bullish outlook in the market. This optimism significantly increased when Ethereum reached $3K, mirroring the surge in March 2024 that also resulted in an all-time high (ATH).

In simpler terms, when funding rates are positive, it usually means there’s strong demand in a rising market. However, high funding rates might serve as a warning sign. They suggest that the futures market is overheated, which could lead to forced selling if the price meets resistance or undergoes a correction. This could trigger a chain reaction of more selling, known as a long liquidation cascade.

In the current market climate, with funding rates at heightened levels, the risk of increased volatility and potential corrections rises. An overheated market could lead to rapid sell-offs, especially if liquidations are triggered by profit-taking or minor corrections. Therefore, investors should manage risk carefully, anticipating short-term fluctuations and preparing for potential volatility.

Read More

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

2024-11-12 16:33